What Percentage Of Gdp Is Industry And Services In Us

Released: 2022-04-29

Real GDP by industry

February 2022

one.1%

(monthly change)

Existent gross domestic product (Gross domestic product) rose 1.1% in February, the largest monthly growth rate since March 2021, as wide-based increases across most sectors contributed to the ninth consecutive monthly expansion in economic output.

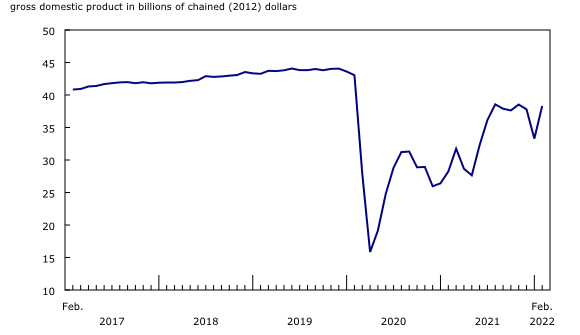

Chart ane

Real gross domestic production grows in February

Both services-producing (+0.nine%) and goods-producing (+one.5%) industries were up, as 16 of 20 industrial sectors expanded in Feb.

Advance data indicates that real Gdp increased 0.5% for March. Client-facing industries led the growth on continued reopening of activities and easing of restrictions put in identify at the onset of Omicron variant. Increases were besides recorded in the manufacturing and structure sectors. The wholesale sector posted a decline. This advance information for real Gross domestic product by industry indicates a 1.4% increase in the start quarter of 2022. Attributable to their preliminary nature, these estimates volition be updated on May 31 with the release of the official GDP data for March and the start quarter of 2022.

Client-facing industries recapture momentum post-obit easing of Omicron-related restrictions

As the Omicron moving ridge began to elevation then subside across the country, various levels of government began easing and removing restrictions on indoor gatherings introduced in December 2021 and January 2022, reversing the fortunes of customer-facing industries that bore the brunt of the Omicron wave.

Accommodation and food services bounciness back

The accommodation and food services sector jumped xv.1% in February, offsetting most of the previous ii monthly declines, as both subsectors were upwards.

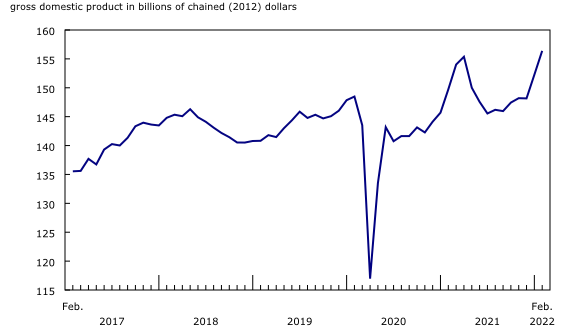

Chart 2

Accommodation and food services grow in Feb

Food services and drinking places jumped 17.6% in February, more than offsetting the declines in December 2021 and January 2022, equally activity increased across the country and at all types of establishments.

Accommodation services rose viii.eight% in February following two months of decline. Traveller accommodation services led the growth, lifted by a higher number of domestic and international travellers in the month.

Transportation and warehousing rebounds

Transportation and warehousing rose 3.1% in February as all subsectors were up, with the exception of couriers and messengers (-1.9%).

Rail transportation rose 9.1% in February, the largest monthly growth rate since May 2014, picking up steam following a period of lower activity in belatedly 2021 and January 2022 brought on by below seasonal cold weather and flooding in British Columbia.

Urban transit systems jumped 23.9% in February every bit ridership increased, largely offsetting declines in the previous two months.

Air transportation (+7.7%) rose for the 10th fourth dimension in 11 months in February as airlines carried more appurtenances and passengers.

Back up activities for transportation rose ii.ix%, stemming from increases in support for rails, water and air.

The arts, entertainment and recreation sector rebounds

The arts, entertainment and recreation sector bounced back with an 8.four% increase in February, following ii months of decline, every bit all subsectors were upwardly.

Amusement, gambling and recreation industries (+9.4%) contributed the most to the growth as many provinces reduced or completely removed capacity restrictions at casinos, bingo halls and other gaming terminals along with gyms, yoga studios, libraries and other amusement facilities.

Performing arts, spectator sports and related industries, and heritage institutions grew 7.1% in February as attendance at professional sporting events increased.

Construction is up for a second month in a row

The structure sector expanded 2.7% in February as all subsectors contributed to the growth.

Nautical chart 3

Construction grows in Feb

Residential building construction rose 3.7% in February, led by abode alterations and improvements and construction of apartment buildings. This was the second consecutively monthly increment.

Non-residential edifice construction increased 1.four% in Feb, representing its eighth consecutive proceeds, with alterations and improvements contributing the virtually to the gain. Industrial building construction too increased, fuelled by several new manufacturing and maintenance edifice projects in Ontario and Quebec.

Existent estate keeps growing

The real manor and rental and leasing sector expanded 0.iv% in Feb, as all subsectors were upwardly. Contributing the near to the growth were offices of real manor agents and brokers (+2.5%) as home resale activity rose in the month, led by Ontario and the Prairie provinces.

Legal services, which derive much of their activity from real manor transactions, increased one.two% in February.

Professional, scientific and technical services rise

In addition to legal services, the bulk of industries comprising the professional person, scientific and technical services sector (+one.0%) also recorded growth in February. Computer systems blueprint and related services (+1.seven%) and other professional person, scientific and technical services including scientific research and development (+ane.4%) contributed the nearly to the growth; just architectural, applied science and related services (-0.iii%) was down. The sector equally a whole has grown almost every month since April 2020 and, in February 2022, was vi.6% above its pre-pandemic level.

Finance and insurance are up as home buyers rush to lock in mortgages

Finance and insurance increased 0.4% in February, up for a ninth month in a row. As markets and investors were preparing for rate hikes signalled by central bankers, many abode buyers rushed to lock in lower mortgage rates from their lenders, leading to a 0.5% increase in depository credit intermediation and other monetary government.

Insurance carriers and related activities rose 0.v% in February and while fiscal investment services, funds and other financial vehicles edged down 0.2%, its level of activity remained high among global geopolitical instability toward the cease of the calendar month.

Widespread growth in mining, quarrying and oil and gas extraction

The mining, quarrying, and oil and gas extraction sector grew 3.4% in Feb, the largest monthly growth rate since December 2020, every bit all subsectors were upward.

Oil and gas extraction expanded 3.0% in February post-obit iii months of decline. Oil sands extraction grew three.1% in February, following production disruptions in January, every bit stiff increases in crude bitumen and synthetic crude production in Alberta led the growth. Oil and gas extraction (except oil sands) rose 2.nine% as both crude petroleum extraction and natural gas extraction were upwardly.

Mining and quarrying (except oil and gas) increased four.7% as all subsectors were up. Coal mining jumped double digits (+27.i%) for the tertiary calendar month in a row in Feb, supporting higher rail movement and exports of the article in the months following disruptions brought on by flooding in British Columbia in tardily 2021.

Metal ore mining increased 1.5%, as all types of metal ore mining grew, while non-metallic mineral mining and quarrying rose 1.4%, led past a 2.9% increment in potash mining.

Support activities for mining, and oil and gas extraction increased 3.3% in February on account of an increase in drilling and rigging services.

Utilities decline following elevated January

Utilities contracted two.3% in February, post-obit strong growth in January (+4.one%) when below seasonal temperatures in many parts of the country had pushed upwards demand for both electricity and natural gas for heating purposes.

Wholesale trade declines

Post-obit six months of growth, wholesale trade declined ane.1% in February, as 5 of nine subsectors were downward.

Personal and household goods wholesaling (-5.six%) contributed the well-nigh to the decline, reflecting lower imports of pharmaceuticals in February. Building fabric and supplies declined for the first time in five months, down four.3% in Feb, as all industries comprising the subsector contracted.

Offsetting some of the declines was a 1.vii% increase in mechanism, equipment and supplies wholesaling, buoyed up by large imports of industrial machinery, equipment and parts.

Retail merchandise edges downwards

Post-obit iii.0% growth in Jan, retail trade edged downwards 0.2% in February, as 7 of 10 subsectors decreased. Excluding motor vehicle and parts dealers, retail trade rose 0.8%.

Following an elevated level of activity in January, motor vehicle and parts dealers contracted 5.5% in February, with lower action at new car dealers contributing the most to the decline.

Clothing and wearable accessories stores rose nine.7% in February, offsetting much of the previous two declines and benefiting from easing of indoor capacity restrictions across the land.

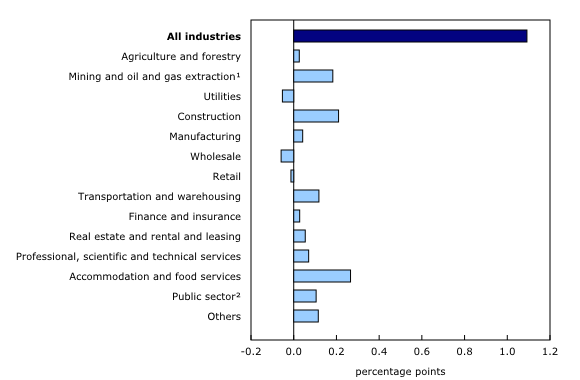

Nautical chart four

Principal industrial sectors' contribution to the per centum change in gross domestic production in Feb

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following xv years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by manufacture is an example of how Statistics Canada supports global sustainable development goal reporting. This release will be used to help measure the following goal:

Note to readers

Monthly information on gross domestic production (Gdp) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the information for each industry and each amass are obtained from a chained volume index multiplied by the manufacture's value added in 2012. The monthly information are benchmarked to annually chained Fisher book indexes of Gross domestic product obtained from the abiding-price supply and use tables (SUTs) up to the latest SUT year (2018).

For the period starting in January 2019, data are derived by chaining a fixed-weight Laspeyres volume index to the prior period. The fixed weights are 2018 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, encounter Seasonally adjusted data – Frequently asked questions.

An advance guess of industrial production for March 2022 is available upon request.

For more data on Gdp, see the video "What is Gross domestic product (Gdp)?"

Revisions

With this release of monthly Gdp by industry, revisions accept been made back to Jan 2021.

Each month, newly bachelor administrative and survey data from various industries in the economy are integrated, resulting in statistical revisions. Updated and revised administrative information (including taxation statistics), new information provided past respondents to manufacture surveys, data confrontation and reconciliation process and standard changes to seasonal adjustment calculations are incorporated with each release.

Real-time tabular array

Real-time table 36-10-0491-01 volition be updated on May 9.

Next release

Data on GDP past industry for March will be released on May 31.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-10) is besides available.

The Economic accounts statistics portal, attainable from the Subjects module of the Statistics Canada website, features an upwardly-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to inquire about the concepts, methods or data quality of this release, contact united states (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

What Percentage Of Gdp Is Industry And Services In Us,

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/220429/dq220429a-eng.htm

Posted by: chaconundeng.blogspot.com

0 Response to "What Percentage Of Gdp Is Industry And Services In Us"

Post a Comment